- About Us

We understand that our success is completely dependent on your success and our values reflect that

Your business is unique and so is our approach. Its designed to deliver the best value to our clients

We value our strong global partnerships who help us deliver on our vision

- ERP Solutions

Let our team of Oracle Experts help you modernise and transform your business

A more Strategic Approach for getting the most out of your Oracle System

Reliable and affordable Managed support services for your Oracle investments

Everything from Cloud Assessment & Health Checks to DB Services & Devops

- Products

WinfoTest takes the pain out of your Oracle Updates. Engineered specifically FOR Oracle BY Oracle Experts

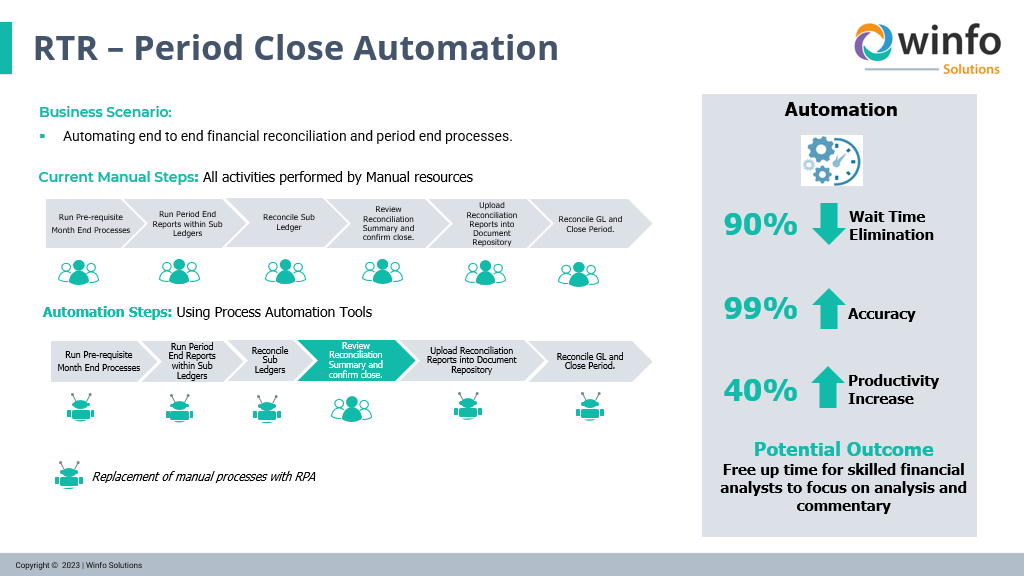

WinfoBots is an intelligent process automation tool powered by UiPath and Engineered by Oracle Experts

WinfoData is AI driven predictive analysis to forecast the future rather than analysing the past

- Insights Hub

From our team of experts to bring you insights, tips and tools geared to support your Oracle ERP systems

Learn first-hand how other client’s overcame their challenges to unleash the power of their ERP systems

Live and virtual events and webinars where the Winfo team share their knowledge, showcase new products and services that help manage your Oracle ERP systems

Visit our library of On-Demand Videos, where you can watch back webinars and other videos to boost your Oracle ERP systems’ efficiency and ROI

- Career Centre

We value our employees as an integral part of the team and work to appreciate & reward their efforts

Our people are our biggest asset, so we seek to keep your skills updated with continuous learning

Its an ongoing challenge to manage personal and professional life, and we work hard to help balance the scale.

Search through Winfo’s current open roles and find your next path to success.